Apple has introduced a new feature to define a Tax Category to apps and In-App Purchases. This is the good moment to summarise everything Apple does for developers on that VAT topic.

The App Store is an amazing place to easily and quickly make business worldwide. Your products are instantly available in 175 countries, subscriptions can be purchased in 45 currencies using one of the 200 supported payment methods.

Apple handles the currency exchange rates, support and refund requests in 40 languages and most importantly Apple administers VAT on behalf of app editors in 64 territories.

This is saving huge paperwork and efforts from managing the complexity of paperwork and VAT returns filing.

Quickly set-up and launch subscriptions that comply with Apple, Google and Huawei guidelines to enjoy faster time to revenue and avoid rejections and delays.

Starting July 21st 2021 Apple allow every app editor to define a category to the app and each In-App Purchase item.

This category will be used by Apple to apply the most adapted tax rate in every country which could save editors a massive amount of money as taxes may be lower for some items (books, songs, …) in some countries.

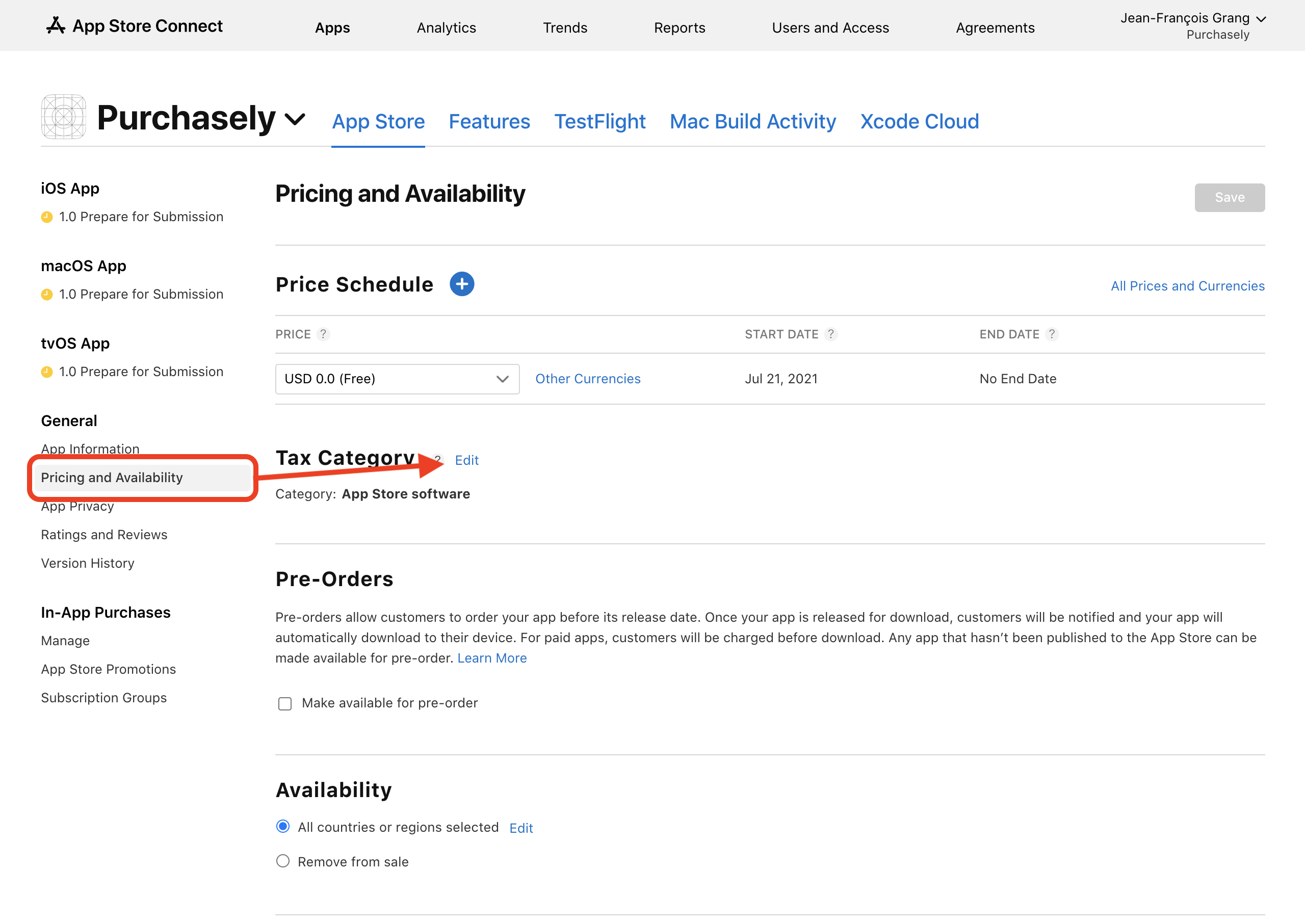

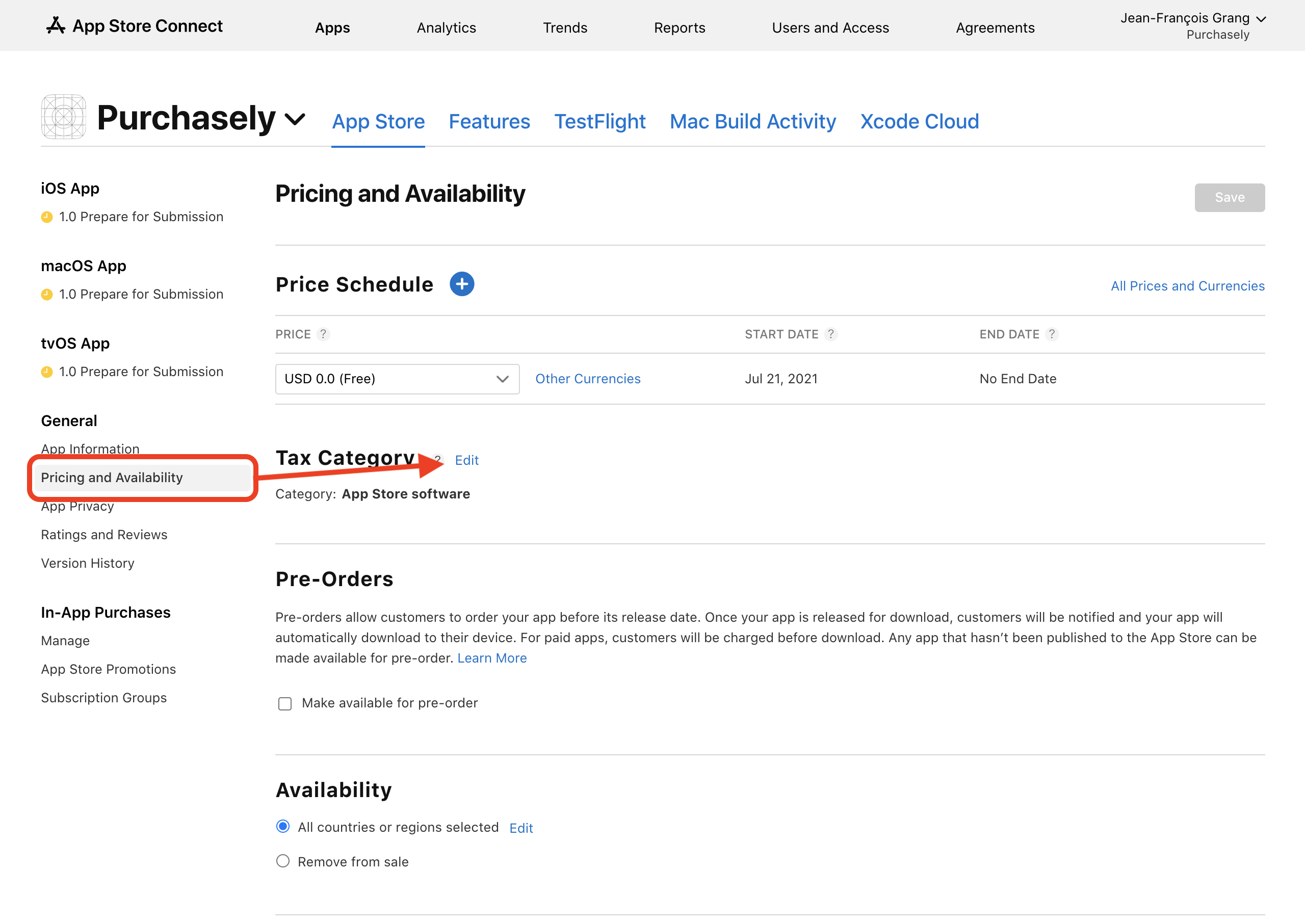

This can be applied in few minutes on App Store Connect.

Select Pricing and availability then Edit your Tax Category.

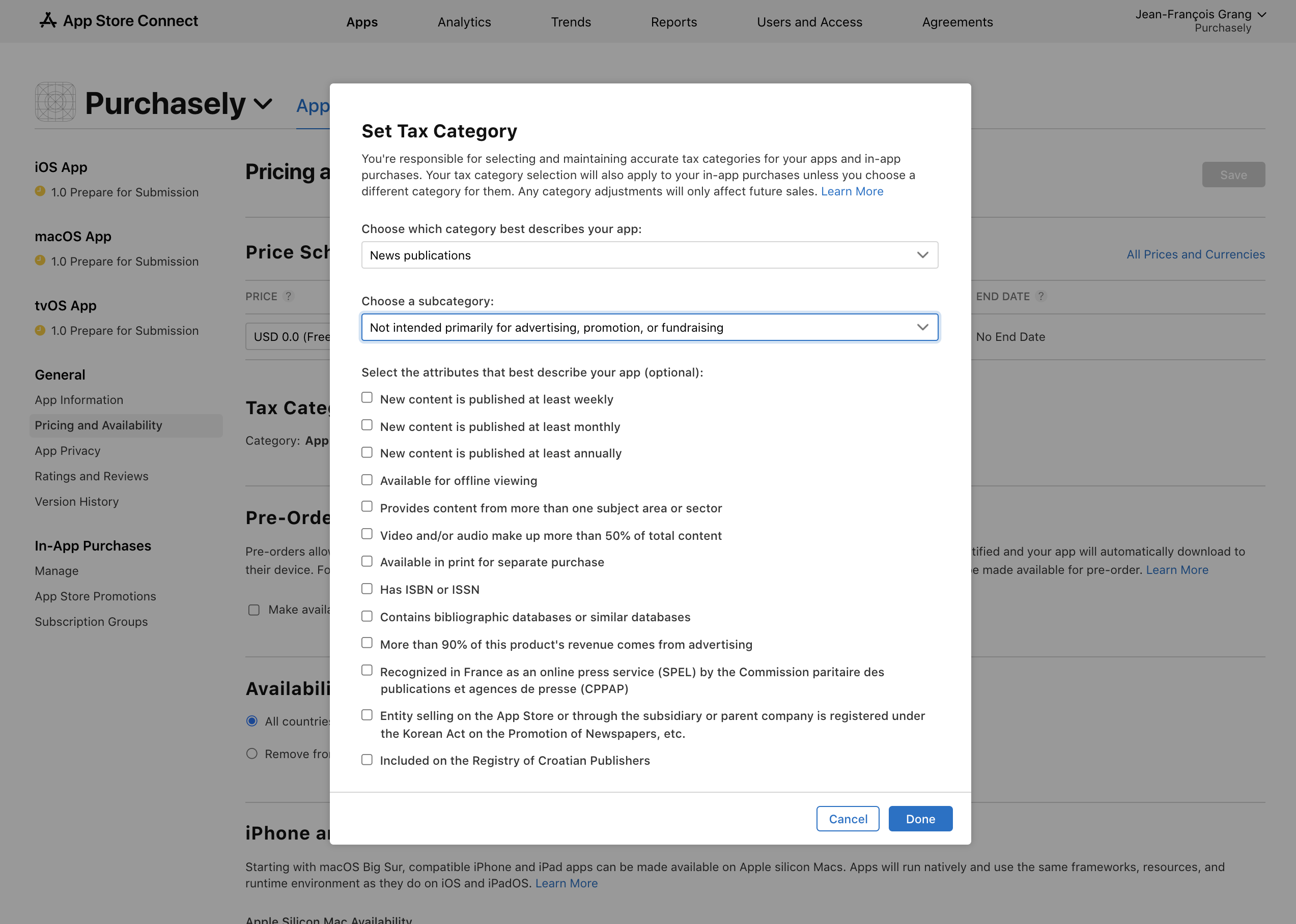

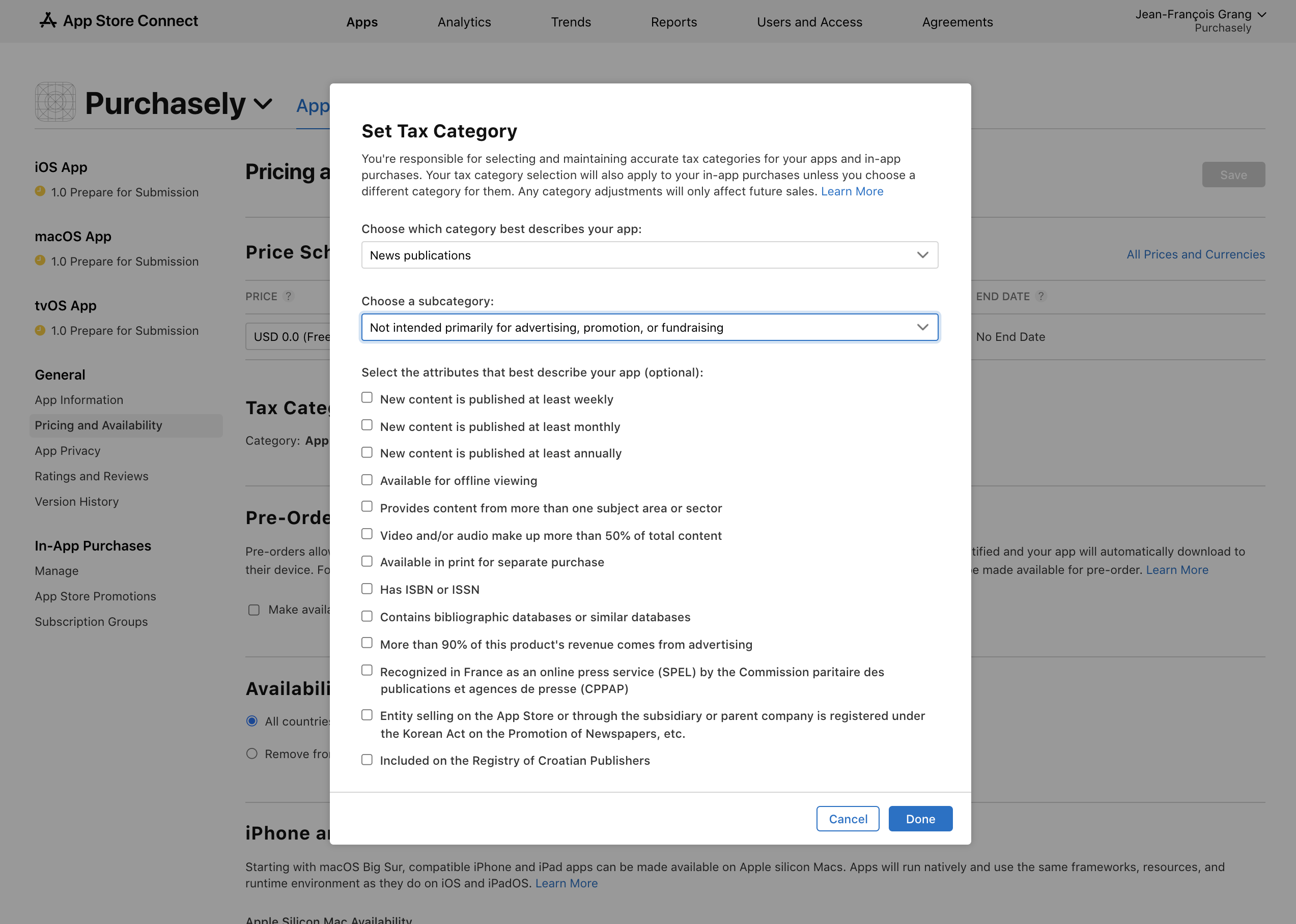

You will be able to choose between many different category based on your app content. Select the one that fits your app (if any).

If you hesitate, check this documentation.

.png?width=2561&name=Capture%20d%E2%80%99%C3%A9cran%202021-07-21%20%C3%A0%2015.28.13%20(2).png)

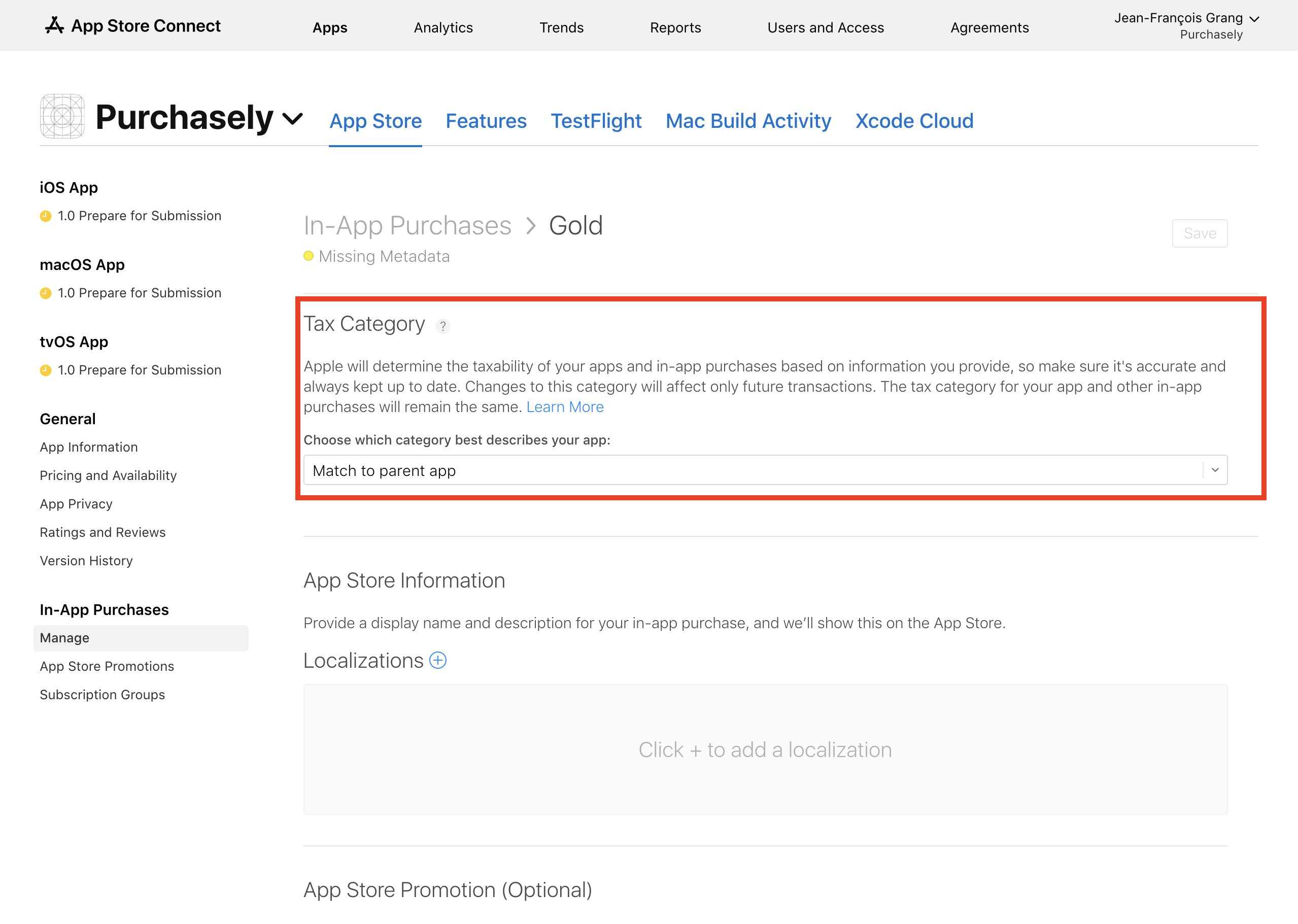

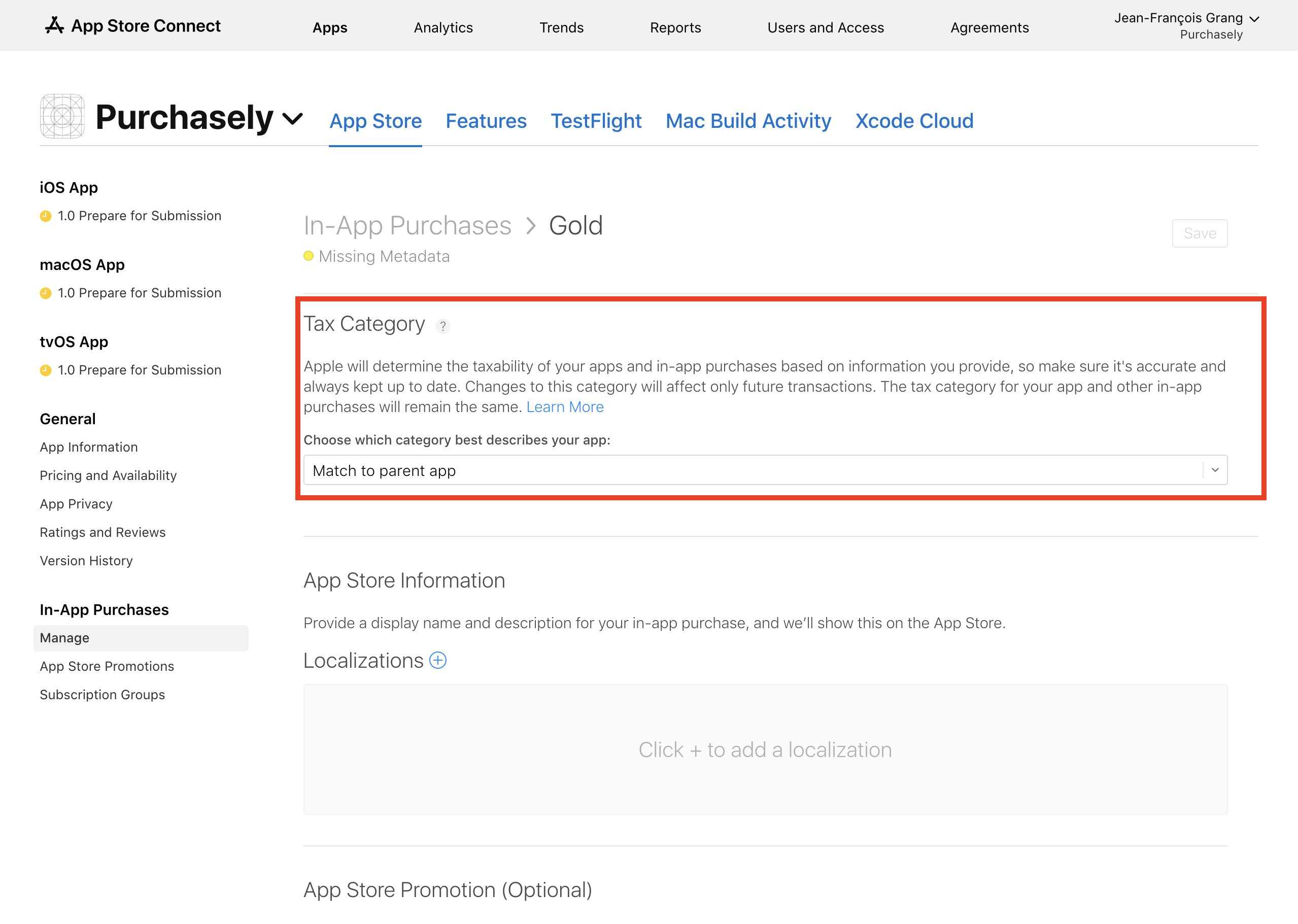

This setting will apply to every In-App Purchase product. You can override this and set a different Tax Category for each product.

Our In-App Purchase flow screens give you complete control to engage and retain subscribers and boost sales, enhance your brand and improve your customer experience.

Depending on the category, Apple might be asking additional informations to check eligibility to lower tax rates in some countries.

For example french newspapers have a 2.1% VAT instead of 20%.

This leads to additional forms made to determine your eligibility. Fill them cautiously as they engage your company.

Once Tax Categories are set, you can check your future proceeds changes in the "All prices and currencies" link from the "Pricing and Availability" page (it might take up to 1 hour to be updated).

These settings will be applied to the first full month after you applied the changes. A new Transaction Tax report will also be available in the Payment and Financial Reports.

Take some time to define your category, you might save you some overpaid taxes.

.png)

.png)

.png?width=2561&name=Capture%20d%E2%80%99%C3%A9cran%202021-07-21%20%C3%A0%2015.28.13%20(2).png)